Payday super and STP reporting

The new concept of “qualifying earnings” (QE) is set to take over as the basis for real-time super compliance, taking over from Ordinary Time Earnings (OTE).

This brings a big change to Single Touch Payroll (STP) reporting to the ATO.

Payday Super is law

Payday Super is now law. The start date is 1 July 2026. This provides a high level overview.

ATO warns about incorrect contractor classification and NSW Revenue wins on Uber

There are many misconceptions about the distinction between contractors and employees and significant case law developments in recent years, together with changes to the Fair Work Act. This remains an area in which it is essential to have robust procedures and take advice on complex scenarios.

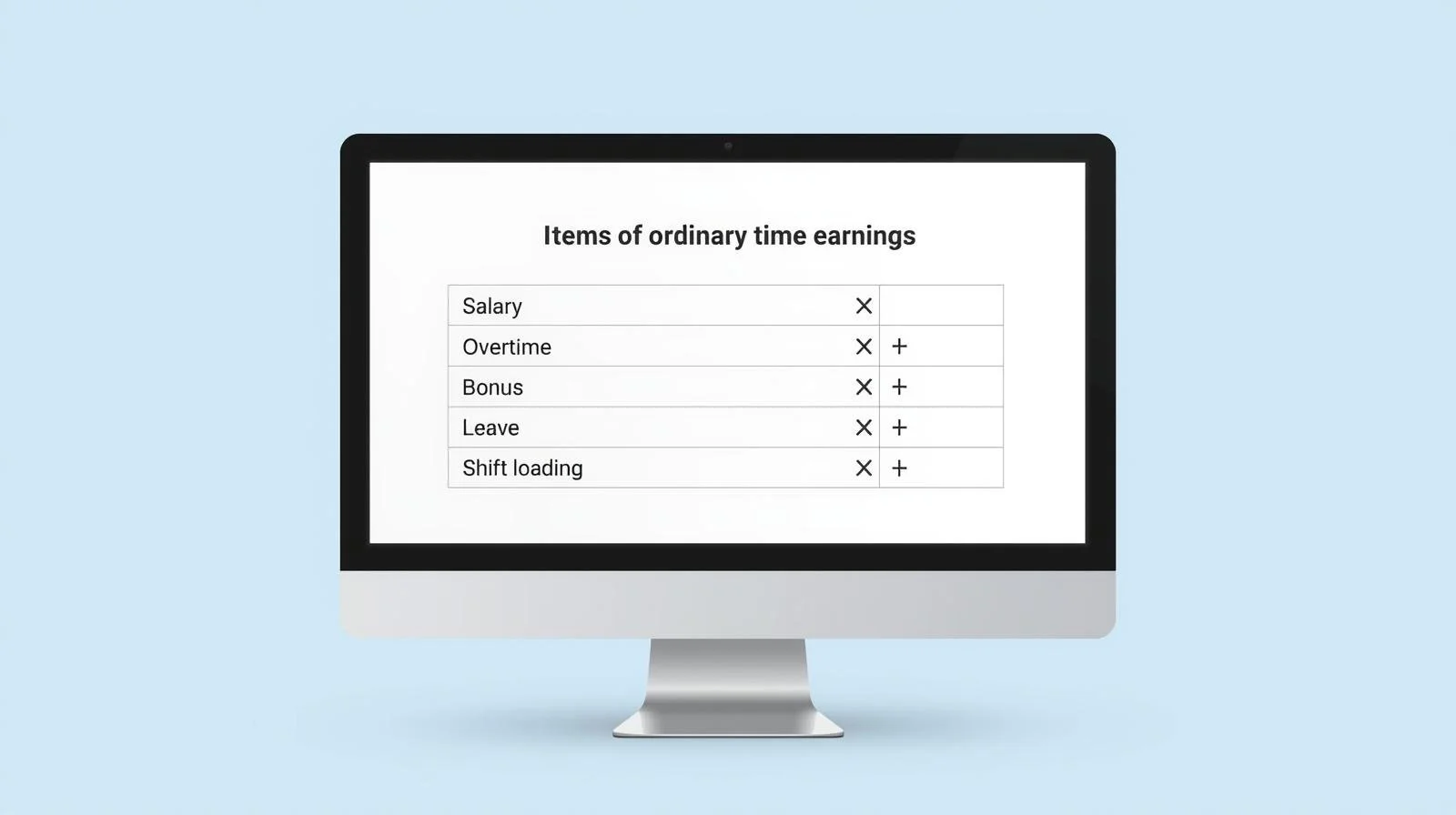

ATO updates guidance on OTE

In August 2025 the ATO issued supplementary guidance on the meaning of OTE. This is particularly relevant under the Payday Super regime, where penalties will start to accrue automatically if OTE isn’t correctly identified at the time each payment is made.

Payroll & tax as year-end looms

EOFYS has become a widely recognised acronym but for hard-working payroll professionals, the end of the financial year isn’t about getting a deal on a car or sofa. It’s the last chance to get on top of niggling issues that can cause problems down the line, before the cycle starts all over again. What are some key considerations for employment taxes?

Plumber not deemed to be an employee for SG

Deeming provisions for superannuation guarantee (SG) can create unbudgeted costs in relation to contractors. The recent Federal Court decision in FCT v Hatfield 2025 FCA 182 is another example of the vexed question of when the extended definition of employee in section 12(3) of the Superannuation Guarantee (Administration) Act 1992 applies.

The most common Super Guarantee (SG) mistakes

The ATO has shared some of the most common errors made by employers. With Payday Super on the horizon, it’s important for employers to ensure risk areas are addressed, to avoid penalties and significant costs.