ATO loses fight on redundancy

Substantial changes in hours, remuneration and working days may be sufficient for a position to be regarded as genuinely redundant.

The Commissioner of Taxation has lost an appeal to the Full Federal Court, resulting in an employment termination payment being classified as a genuine redundancy payment.

This outlines the decision in Commissioner of Taxation v Baya Casal [2026] FCAFC 11

Payday super and STP reporting

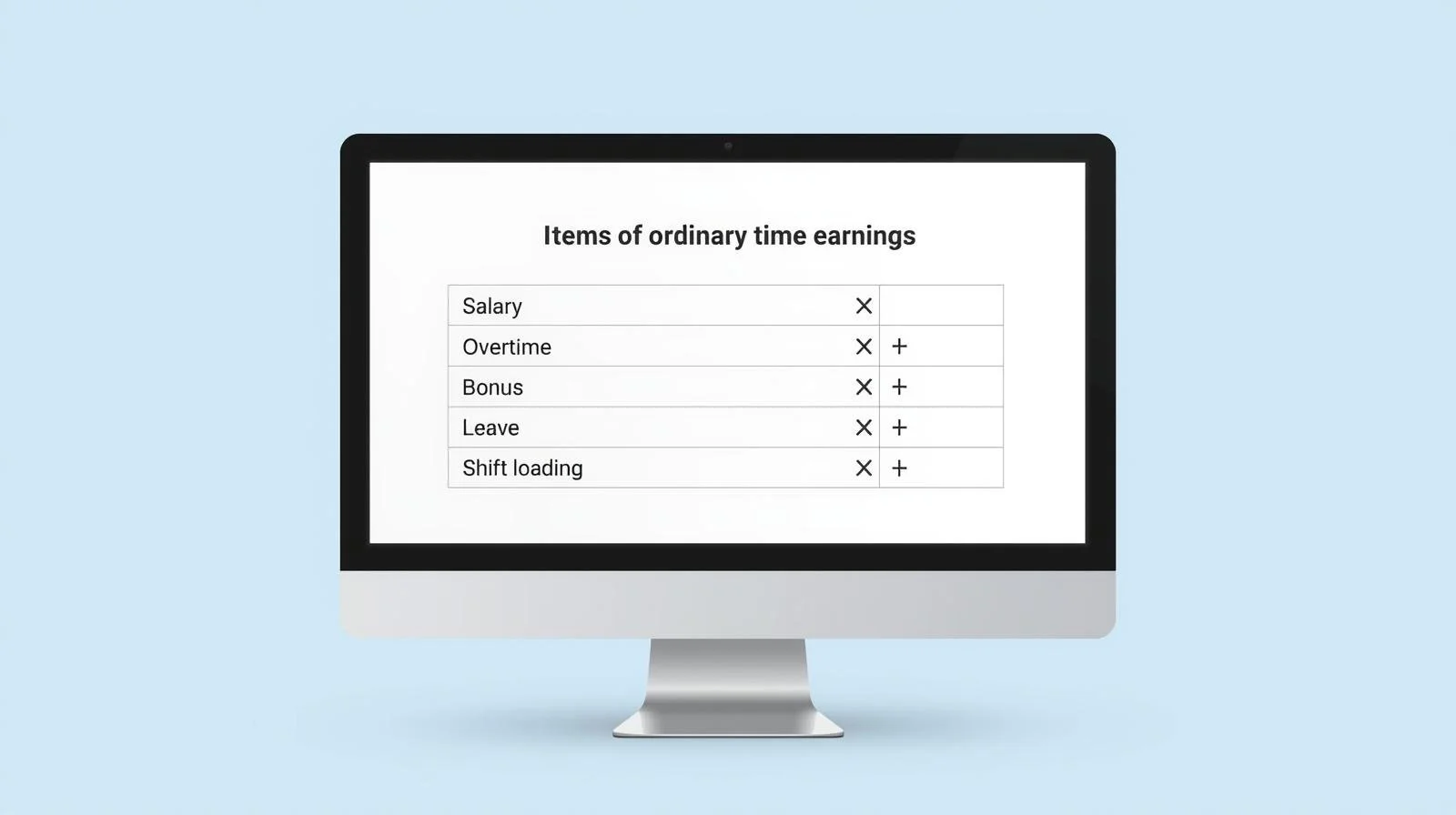

The new concept of “qualifying earnings” (QE) is set to take over as the basis for real-time super compliance, taking over from Ordinary Time Earnings (OTE).

This brings a big change to Single Touch Payroll (STP) reporting to the ATO.

Wellbeing programs that don’t create tax pain

As AI erodes many traditional tasks at work and beyond, the opportunity arises to better support the most important aspects of being human: mindfulness, health and longevity, wellbeing and connection to others. So how can employers do this without incurring Fringe Benefits Tax?

Payday Super is law

Payday Super is now law. The start date is 1 July 2026. This provides a high level overview.

ATO warns about incorrect contractor classification and NSW Revenue wins on Uber

There are many misconceptions about the distinction between contractors and employees and significant case law developments in recent years, together with changes to the Fair Work Act. This remains an area in which it is essential to have robust procedures and take advice on complex scenarios.

ATO updates guidance on OTE

In August 2025 the ATO issued supplementary guidance on the meaning of OTE. This is particularly relevant under the Payday Super regime, where penalties will start to accrue automatically if OTE isn’t correctly identified at the time each payment is made.

Payroll & tax as year-end looms

EOFYS has become a widely recognised acronym but for hard-working payroll professionals, the end of the financial year isn’t about getting a deal on a car or sofa. It’s the last chance to get on top of niggling issues that can cause problems down the line, before the cycle starts all over again. What are some key considerations for employment taxes?

5 FBT traps

FBT is finicky, it only comes up once a year and there’s always potential for trouble when employees receive reportable benefits amounts or when the Public Officer needs to be reassured that the return is true and correct.

So where do things most often go wrong?

Outsourcing salary packaging: What to know

It’s important to understand that outsourced salary packaging providers are essentially focused on specific elements of administration.

Implementing appropriate policies remains the employer’s responsibility and employers bear the cost of FBT and the ultimate risk of anything going wrong.

Will a novated lease really save your employees money?

It depends…

In simple terms, salary packaging an exempt electric vehicle (EV) will almost certainly result in a saving, compared to the employee leasing or financing a car directly. Salary packaging effectively enables a tax deduction for the lease costs, charging, repairs, maintenance and insurance costs. That’s likely to add up to a significant amount.

Plumber not deemed to be an employee for SG

Deeming provisions for superannuation guarantee (SG) can create unbudgeted costs in relation to contractors. The recent Federal Court decision in FCT v Hatfield 2025 FCA 182 is another example of the vexed question of when the extended definition of employee in section 12(3) of the Superannuation Guarantee (Administration) Act 1992 applies.

New case redefines car parking outside CBDs

The Fringe Benefits Tax (FBT) decision of the Federal Court on car parking in Toowoomba Regional Council v Commissioner of Taxation [2025] FCA 161 is great news for employers with businesses outside the CBD. Justice Logan also provides some pithy reminders that are relevant to tax interpretation and disputes more generally. Here’s a summary of both the FBT impact and broader considerations, and a look at what to do next if this affects you.

The fine line in residency: Contrasting the decisions in Harding and Quy

Two engineers, each of whom worked in a low-tax overseas location while continuing to own homes in Australia in which their respective families resided. One breaks Australian residency, the other does not. This summary outlines the key differences in the two decisions.

5 salary packaging myths

The rate of FBT is high, virtually equal to the cost of the benefit. This, combined with the various exemptions and reductions in FBT that are specific to Australia, have resulted in a thriving industry around salary packaging. But how well do employers and employees understand salary packaging?

Here are some of the most common misconceptions.

FBT exemption for EVs at a glance

The FBT exemption for EVs can provide significant savings to employers and employees under salary packaging arrangements. But it’s important to understand some of the tricky areas such as what happens when home charging equipment is provided, when the ATO’s home charging electricity rate can be used and the transitional exemption for PHEVs from 1 April 2025.

The most common Super Guarantee (SG) mistakes

The ATO has shared some of the most common errors made by employers. With Payday Super on the horizon, it’s important for employers to ensure risk areas are addressed, to avoid penalties and significant costs.

Introducing an employee share scheme: what every company should know

Employee share schemes can add enormous value to remuneration packages and be highly effective at aligning company and individual objectives. Here are some important considerations for employers considering introducing a new employee share scheme.

5 tips to unlock FBT savings

Are you looking to reduce your FBT costs and maximise your savings? Check out this article sharing practical tips drawn from experience with the largest employers, to help manage the expense of FBT. Get the valuable insights, from leveraging exemptions to utilising data analytics.